.jpg)

The post describes automating crypto sentiment alerts using Make (Integromat) and the Fear and Greed Index API. It explains how to set up notifications when market sentiment indicates fear which ofter signal a good buying opportunity.

The information provided in this post is for informational and educational purposes only and should not be construed as investment advice, financial advice, trading advice, or any other sort of advice. The content is based on the author’s personal opinions and experiences and is not intended to be a recommendation or solicitation to buy, sell, or hold any cryptocurrencies or any other financial instruments. The cryptocurrency market is highly volatile and can result in significant financial loss. Always do your own research and consult with a qualified financial advisor before making any investment decisions.

Investing in the cryptocurrency market can be highly profitable but also fraught with risks and volatility. One of the key indicators that savvy investors look for is market sentiment. When the sentiment is dominated by fear, it can often signal a good buying opportunity.

In this blog post, we will explore how to use Make (if not have an account please register from my ref link) to send notifications when the crypto market sentiment indicates fear. We will leverage the API from alternative.me to track sentiment and automatically send notifications when it falls below a set threshold.

Market sentiment is essentially the overall attitude of investors toward a particular market or asset. In the crypto market, sentiment can swing wildly between fear and greed. The Fear and Greed Index quantifies this sentiment on a scale from 0 to 100, where lower values indicate fear and higher values indicate greed.

Historically, buying during periods of fear has been a profitable strategy, as prices are often lower. By setting up a system to monitor this index, investors can be alerted to potential buying opportunities when fear dominates the market.

To get started, you’ll need to make requests to the Fear and Greed Index. Use a dedicated JSON-based API to avoid struggling with HTML parsing. A sample response from this API looks as follows:

// GET https://api.alternative.me/fng/?limit=1

// Response

{

"name": "Fear and Greed Index",

"data": [

{

"value": "40",

"value_classification": "Fear",

"timestamp": "1551157200",

"time_until_update": "68499"

}

],

"metadata": {

"error": null

}

}In your Make scenario, configure an HTTP GET request to the API endpoint. Parse the JSON response to extract the sentiment value. Set a condition to check if this value falls below a predetermined threshold, indicating fear. If the condition is met, trigger a notification to be sent to your preferred communication channel, such as email, SMS, or a messaging app.

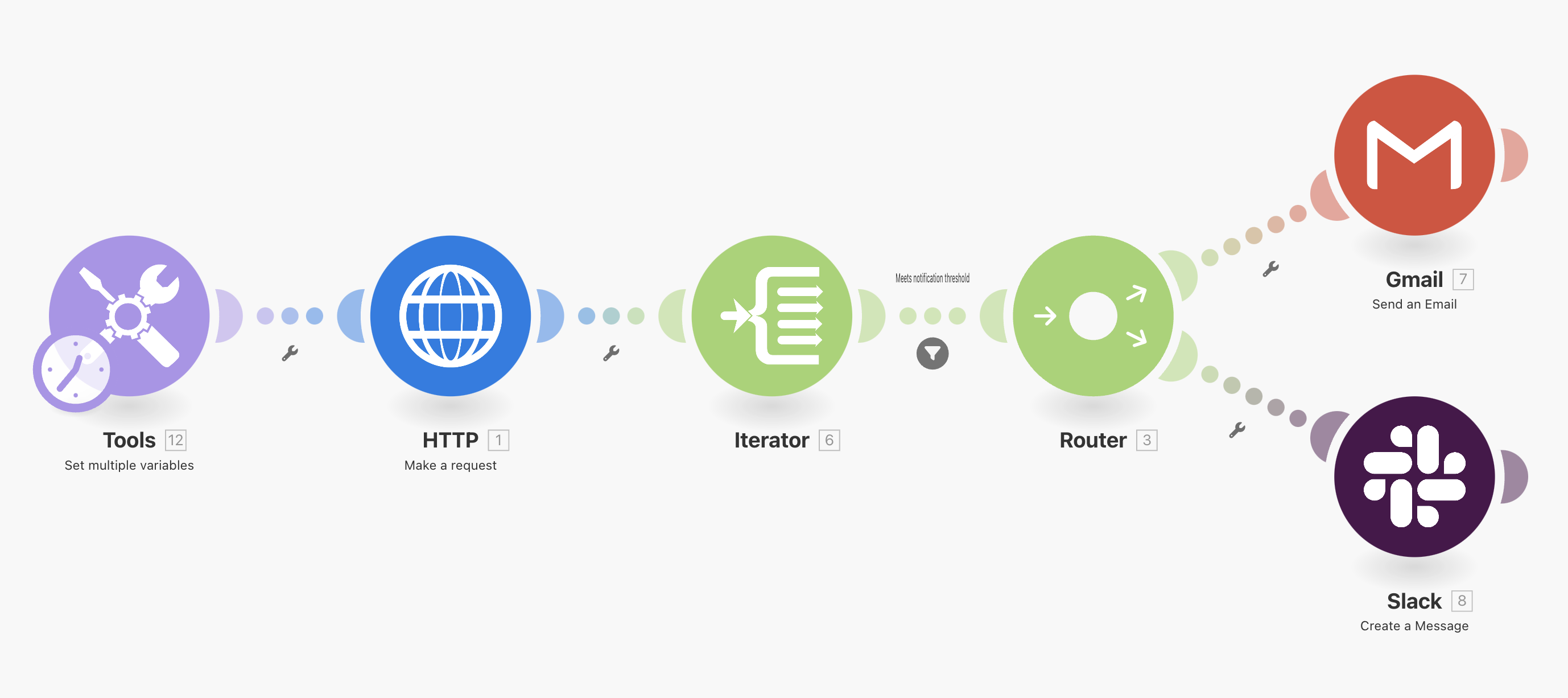

The first scenario is presented below. It makes a Greed&Fear API request to get the current sentiment and sends notifications if the sentiment value is below a given threshold. The detailed steps are described below:

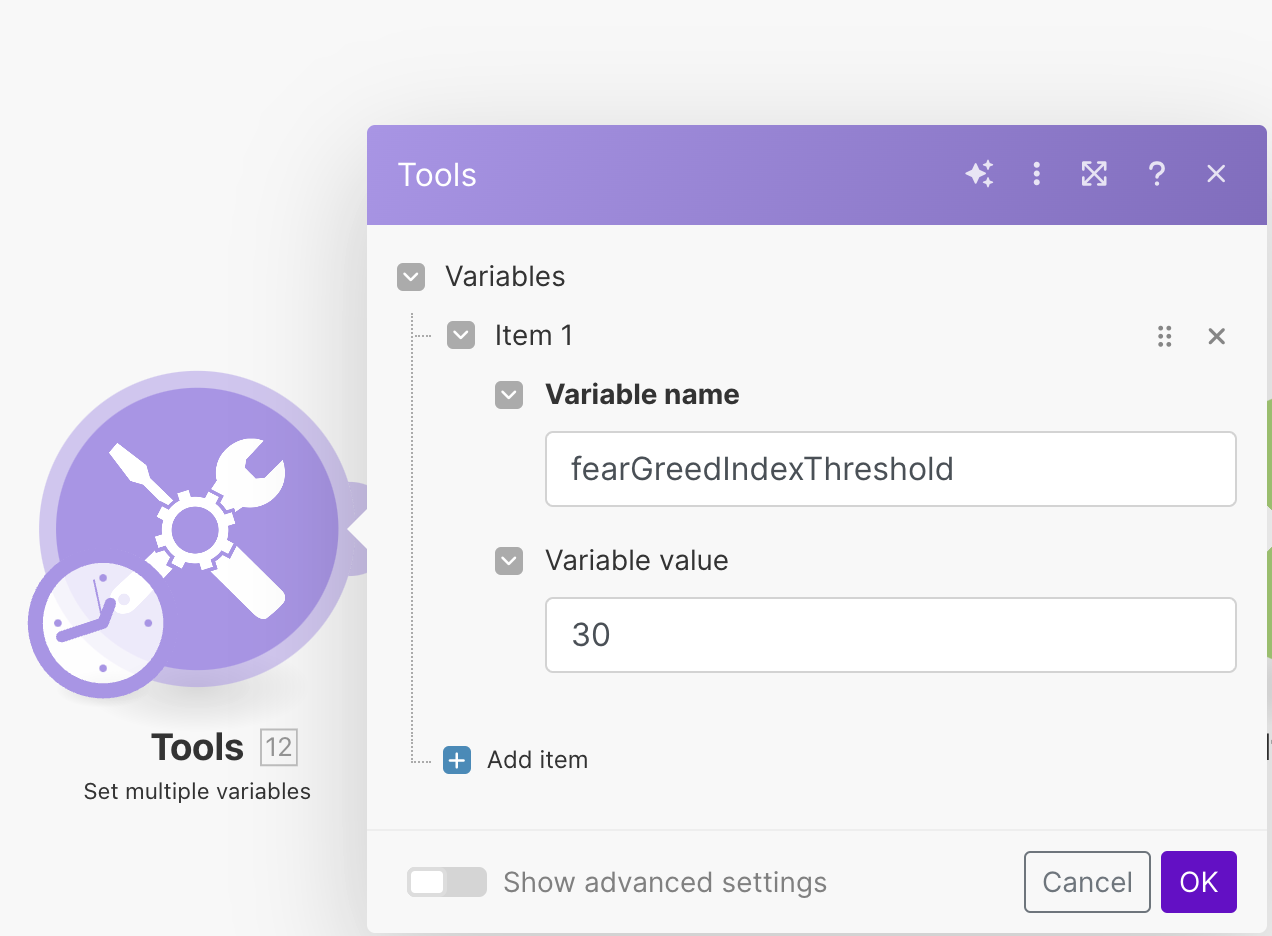

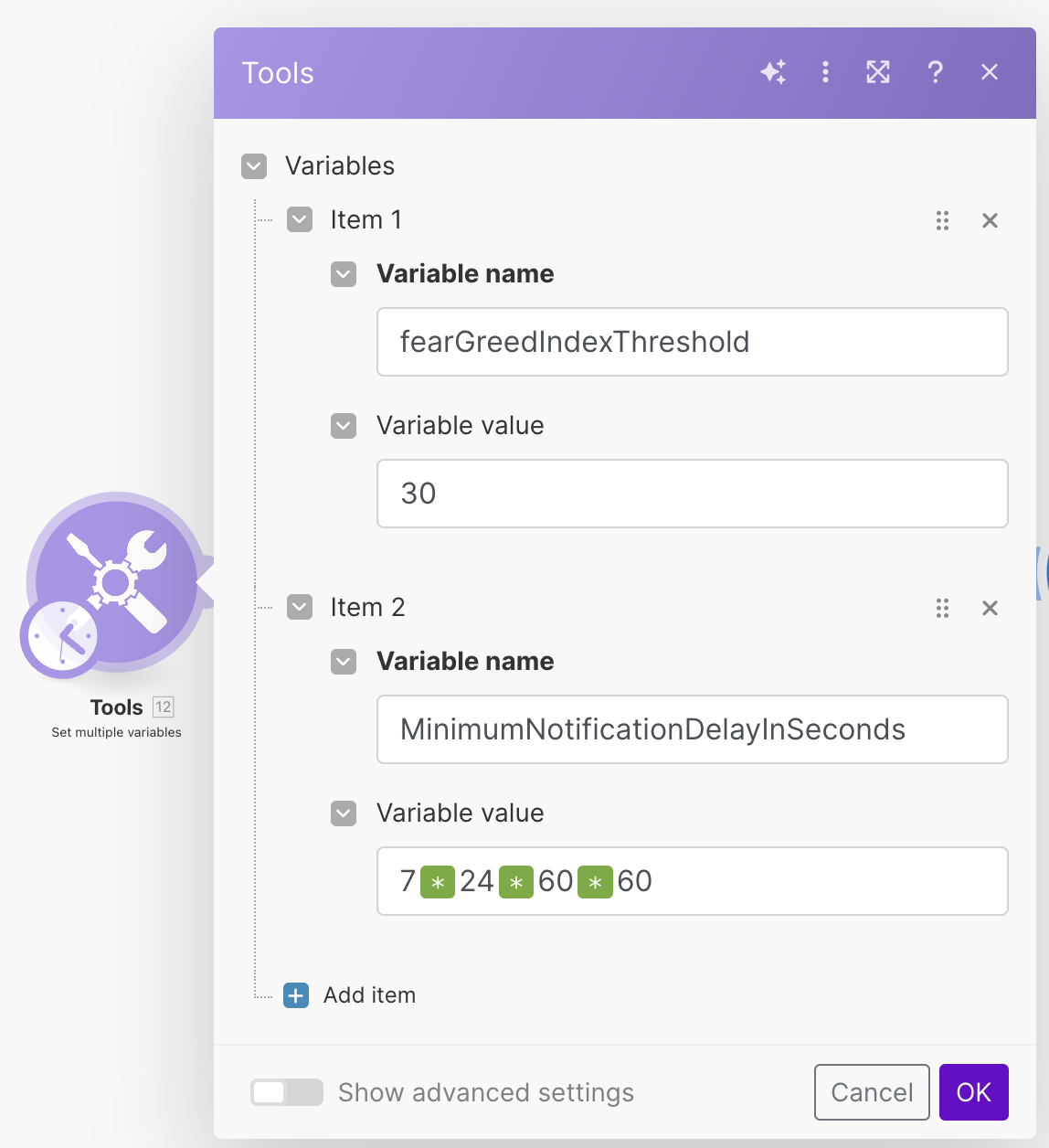

The first step is to declare the Fear&Greed notification threshold. Here, I am setting it to 30, but you can define it based on your observations of historical data:

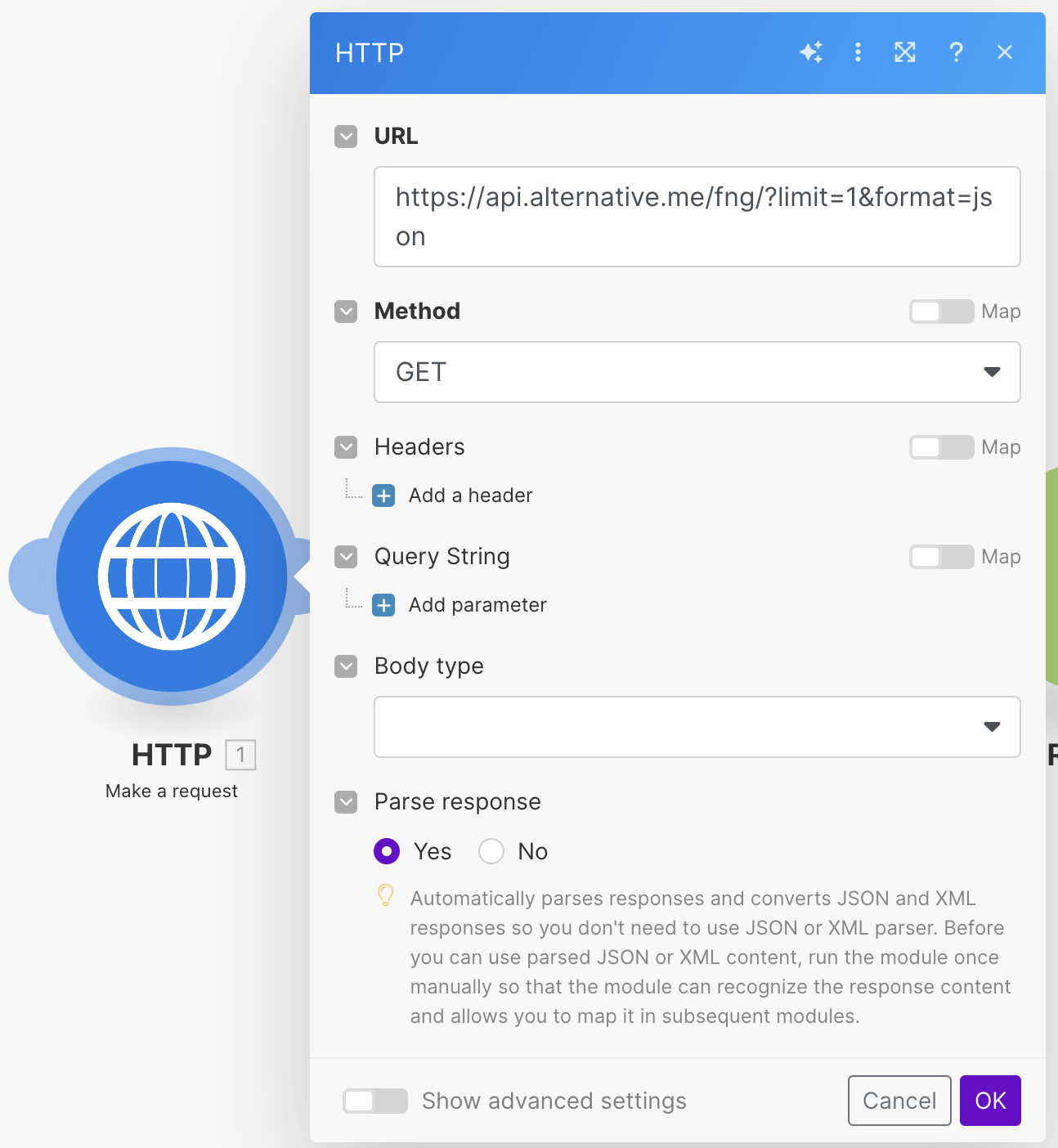

Next, we make a request to the Fear&Greed Index API to get the current sentiment value, which is used in the next parts of the scenario. The only parts to set up here are the URL and Parse response sections. Because I like to be specific, I provide URL parameters, although they are optional.

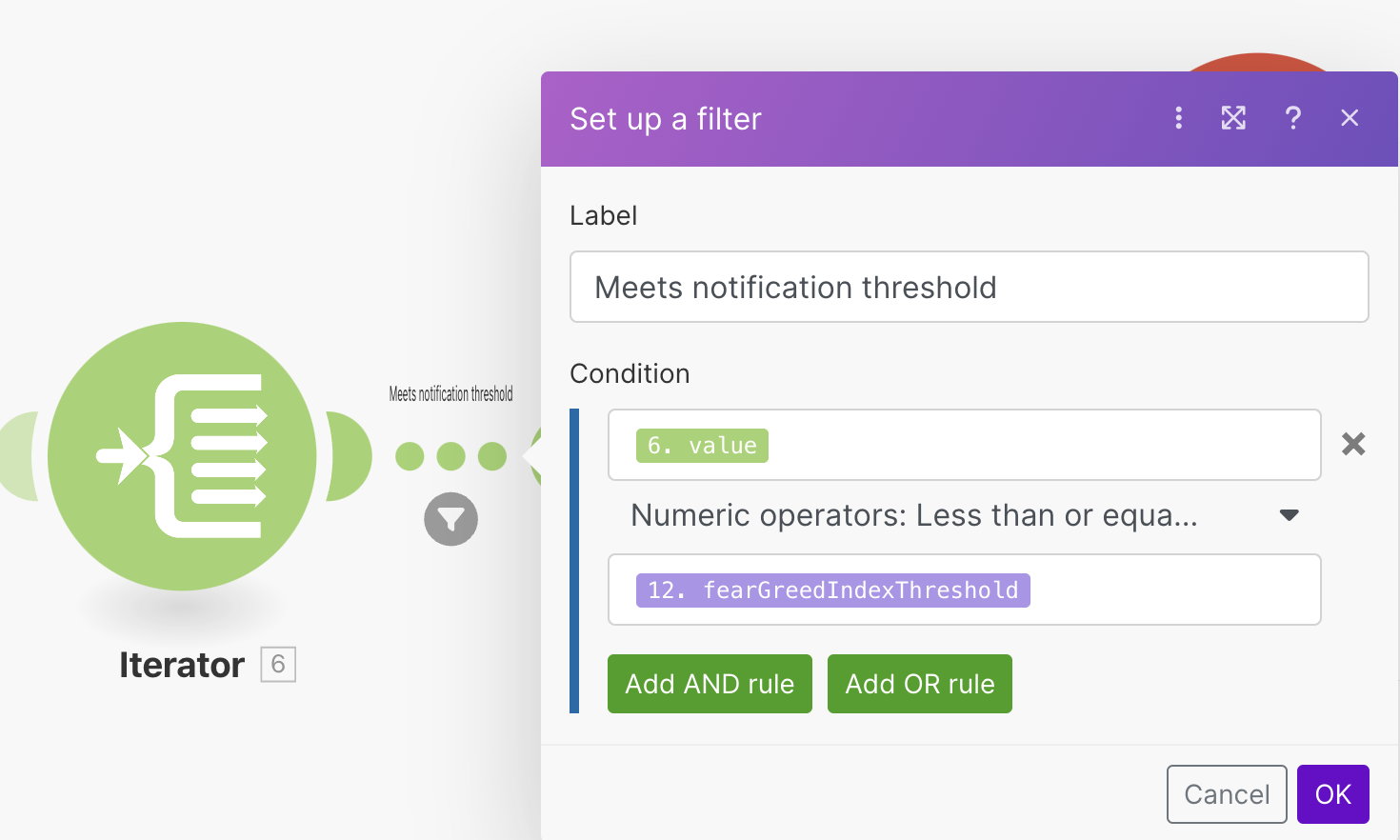

The next important element is a filter, placed between the Iterator and the Router. The filter ensures that the router and the connected nodes execute only once the condition is met. In this case, the current sentiment value (fetched via the API) must be less than or equal to the defined threshold value.

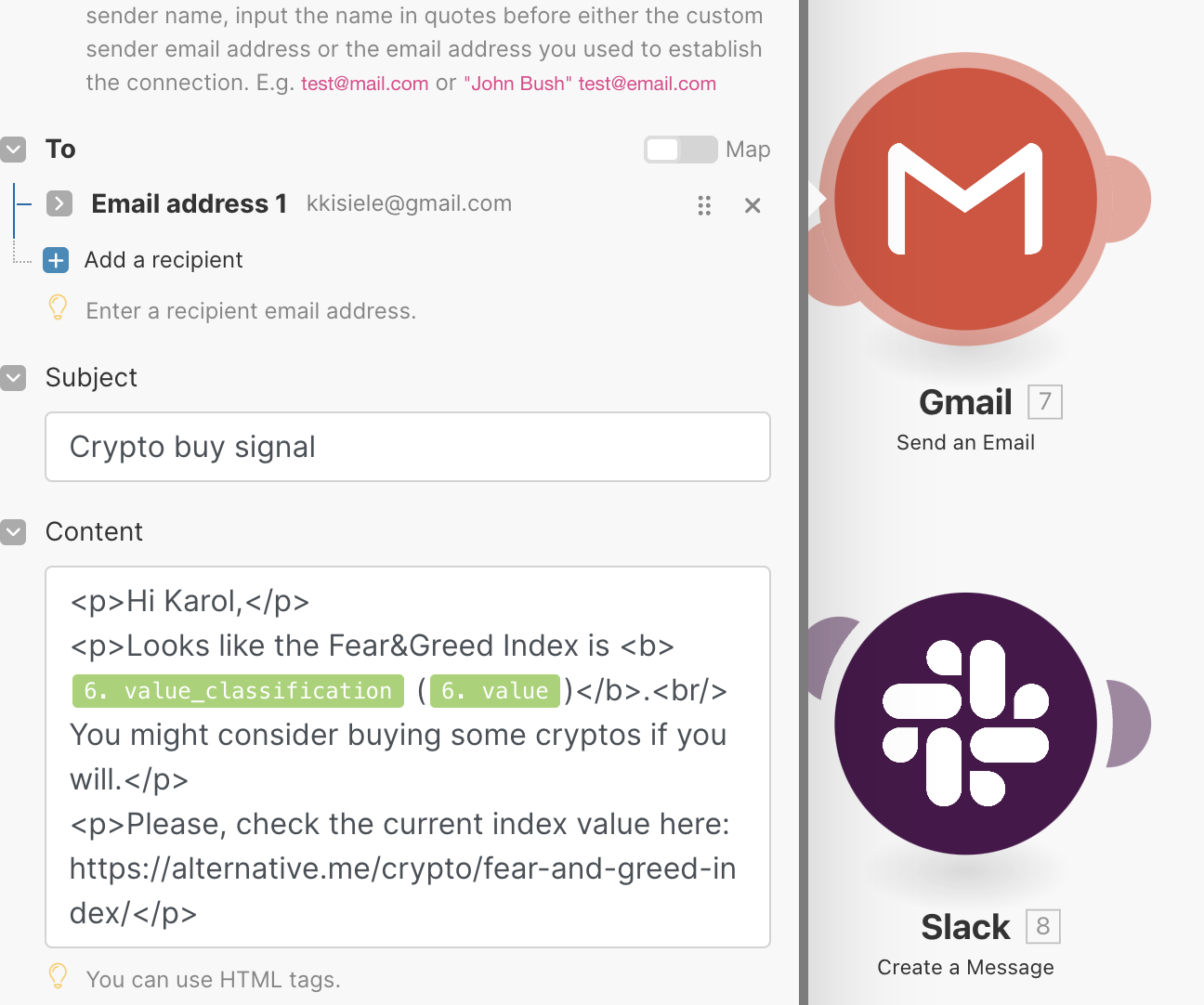

You might choose the notification methods you prefer. I chose email and Slack notifications, and my email setup is:

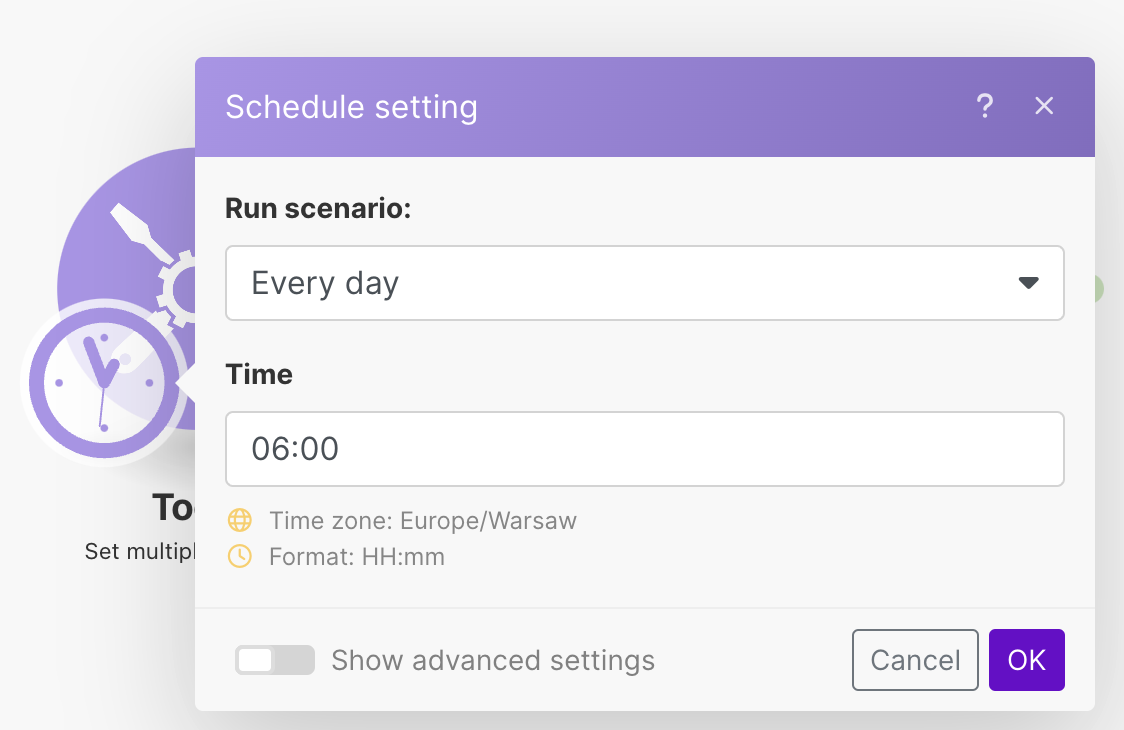

The scenario runs once a day, which is sufficient since the Fear&Greed Index is calculated every 24 hours.

This initial scenario is quite good but has one drawback. During a long-term fear in the market, you might receive notifications every day, which can be overwhelming and undesirable. We will address that in the next part.

In this part, we will improve the scenario by storing the time of the last sent notification. This will ensure we don’t send repeated notifications too often. Once a notification has been sent, the next one (if it meets our threshold) will not be sent sooner than a week later.

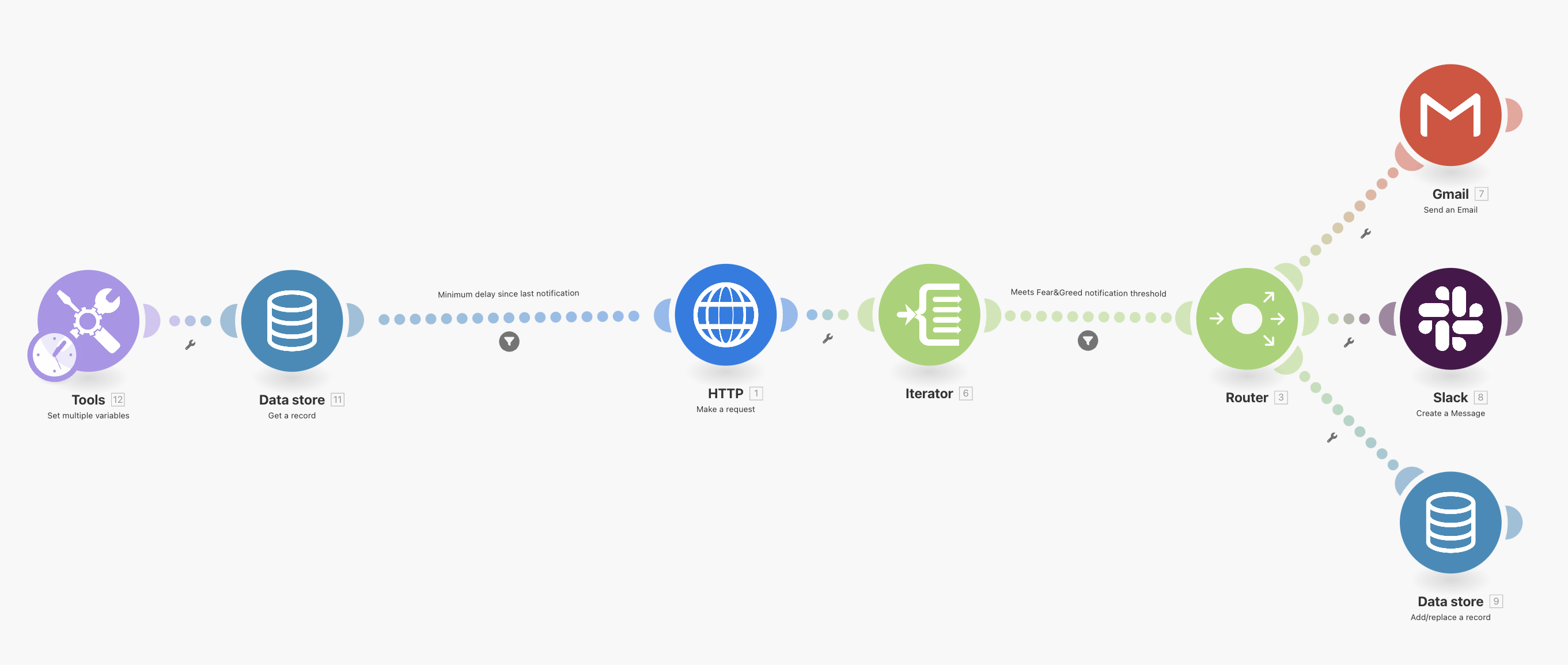

To handle this, we use the built-in Data store. There are two new elements: storing the timestamp of the last sent notification (module 9) and using it at the beginning of the scenario to ensure it runs no sooner than a week since the last notification. The overall scenario view is below:

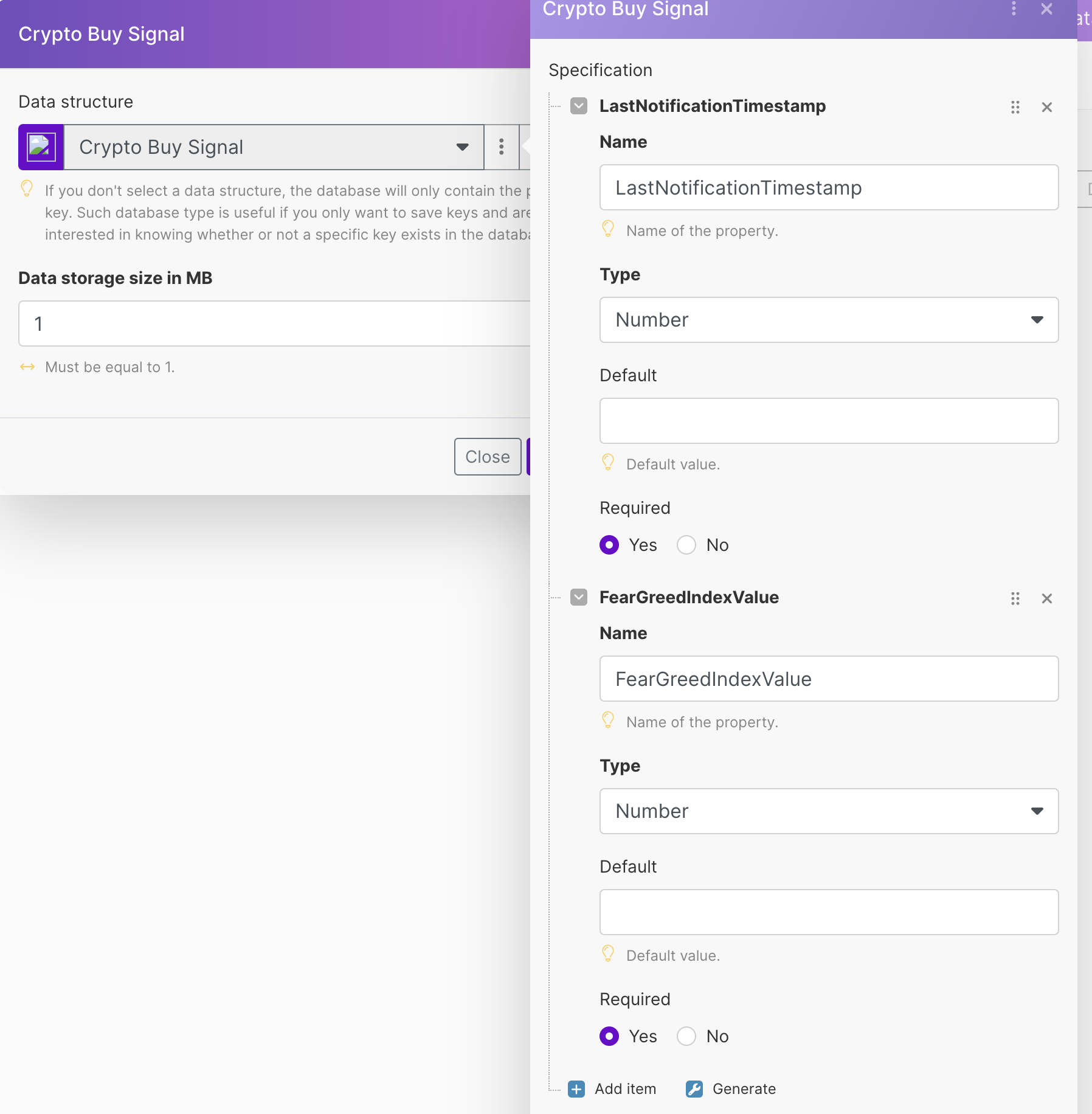

The data store setup is straightforward as it contains only two fields. The last notification date is represented as a Number because it stores the UNIX timestamp value, which is the number of seconds since midnight on January 1, 1970, GMT. There is a Make built-in timestamp function to get it. The second field stores the Fear&Greed Index value.

I added a new variable called MinimumNotificationDelayInSeconds in module 12. This variable is designed to control the minimum amount of time, in seconds, that must elapse before a notification can be sent.

Now we need to get the last notification date from the data store. I use the "one" key to always fetch the same record:

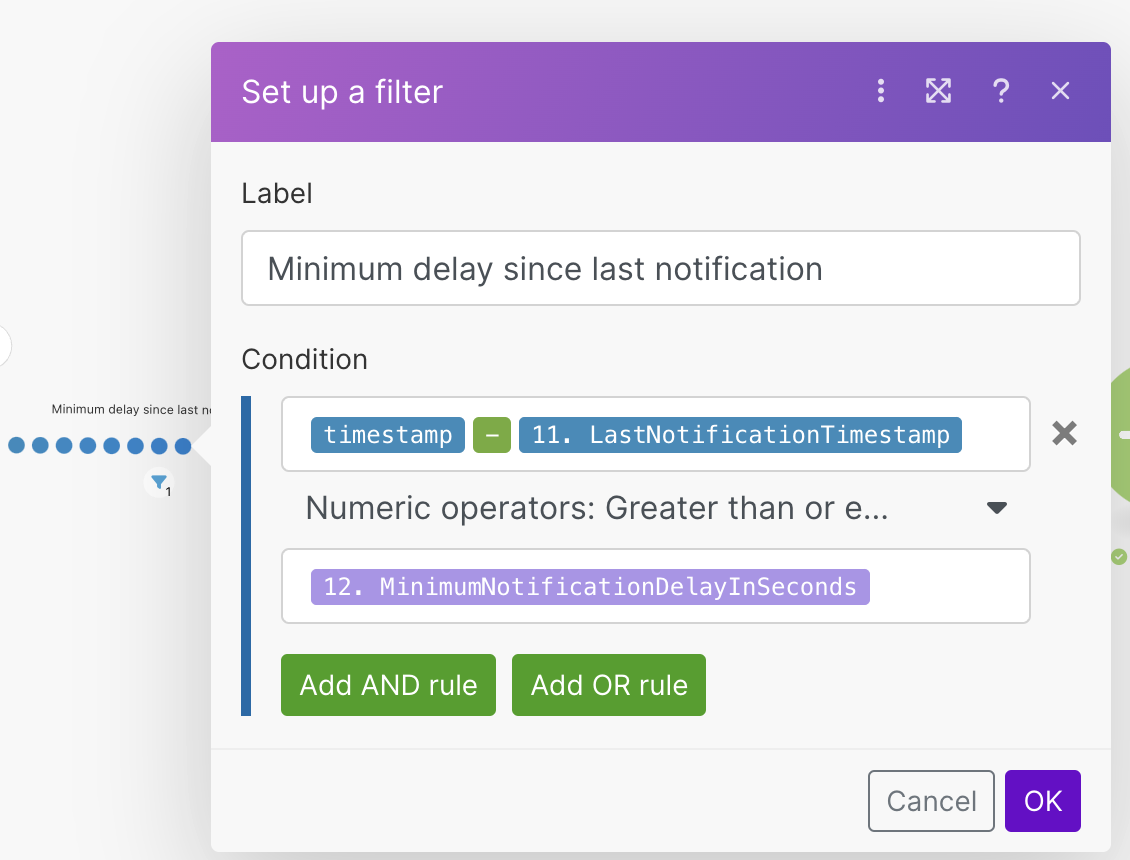

In the filter, we need to check if the number of seconds between the current timestamp and the last notification timestamp is greater than the defined MinimumNotificationDelayInSeconds variable. Only then will the rest of the scenario run.

By leveraging Make and the Fear and Greed Index API, you can automate the process of monitoring crypto market sentiment and receive timely notifications when fear dominates the market. This can help you make informed investment decisions and potentially capitalize on buying opportunities. While market sentiment is a useful indicator, it should be used in conjunction with other analyses and strategies to ensure a comprehensive approach to cryptocurrency investing.